Nordstrom Inc.’s value chain provides goods and services to different retail market segments by using the competitive advantages determined in this VRIN/VRIO analysis of the business. With its relatively small footprint compared to firms like Walmart, Amazon, Target, and Macy’s, Nordstrom manages to keep its profitability despite the decline of competing businesses. In the resource-based view, the retail company’s performance indicates strong core competencies linked to its value chain. The core resources and capabilities in this VRIO/VRIN analysis of Nordstrom reflect competitive advantages that allow the enterprise to attract target customers, given current global market trends. The company’s current condition and performance indicates the suitability of these VRIN/VRIO core competencies to retail business strategies and external factors in the industry. Nordstrom’s generic strategy, business model, and intensive growth strategies reinforce its value chain in providing satisfactory customer service essential in the retail industry.

Facing strong competitive powers in retail and the e-commerce space, Nordstrom strengthens its competitive advantages. This strengthening comes with technological development for online operations. This value chain analysis of Nordstrom shows that e-commerce operations are a key success factor in the business. The company’s strategic management emphasizes its online retail operations’ significance. This VRIO/VRIN analysis of Nordstrom positions the business as a strong competitor in the bargain, midscale, and upscale segments. This approach succeeds through the company’s subsidiaries targeting different retail market segments. Nordstrom Inc.’s corporate mission and vision statements guide these competitive advantages’ utilization in the company’s value chain.

Nordstrom VRIO Analysis & VRIN Analysis (Resource-Based View)

| ORGANIZATIONAL RESOURCES & CAPABILITIES | V | R | I | O | N |

| Competitive Disadvantages: | |||||

| Limited international presence | |||||

| Vulnerability to price elasticity of demand | |||||

| Competitive Parity or Equality: | |||||

| Effective product innovation | ✔ | ||||

| Temporary Competitive Advantage: | |||||

| Strong global supply chain | ✔ | ✔ | |||

| Unexploited Competitive Advantages: | |||||

| Strong capability for expanded multinational retail operations | ✔ | ✔ | ✔ | ||

| Strong capability for diversified online and offline operations | ✔ | ✔ | ✔ | ||

| VRIN/VRIO Core Competencies (Long-term/Sustained Competitive Advantages): | |||||

| Strong brand value | ✔ | ✔ | ✔ | ✔ | ✔ |

| Large-scale complementary upscale, mid-range, and discount operations (luxury and bargain operations) | ✔ | ✔ | ✔ | ✔ | ✔ |

- This VRIO/VRIN analysis table is best viewed using HTML5-compatible browsers.

Non-core Competencies. Nordstrom Inc.’s limited international presence is a competitive disadvantage in the lens of the VRIN/VRIO analysis framework, which assesses resources and capabilities based on Value, Rarity, Imperfect Imitability, Organization (VRIO), and Non-substitutability (N in the VRIN test) to support strategic planning processes. This disadvantage stems from the company’s strategic focus on the North American retail market, particularly the United States. Thus, Nordstrom’s value chain’s potential is limited in providing satisfactory customer service to more markets internationally. In the VRIO/VRIN analysis model, the retail corporation also has the competitive disadvantage of vulnerability to the price elasticity of demand. This vulnerability is based on Nordstrom’s relatively high price points, which make products less attractive during economic downswings. However, the company’s discount subsidiaries, Nordstrom Rack and HauteLook, help buffer this competitive disadvantage. In a competitive power test, these disadvantages present obstacles that reduce the retail company’s value chain’s reach to target customers.

The VRIN/VRIO analysis table presents Nordstrom’s product innovation as strategically valuable. However, this capability provides only competitive equality or parity, relative to other retail firms, which have their respective product innovation resources and capabilities. This innovative capability relates to Nordstrom’s organizational culture, which value the satisfaction of customers whose preferences change over time. On the other hand, the company’s global supply chain, although limited, is a temporary competitive advantage for e-commerce and physical store operations. In the VRIO/VRIN analysis framework, Nordstrom’s supply chain is valuable, but rare only among smaller competitors. Such a condition makes this supply chain a non-core competency in the resource-based view of the business. Even though the supply chain supports the company’s value chain, it does not completely differentiate operations from other businesses in the retail industry.

The unexploited competitive advantages in the VRIN/VRIO table pertain to Nordstrom Inc.’s potential for further growth through strategic changes. For example, considering its strategic position and value chain potential, the company has the opportunity to expand its retail operations to more countries. Currently, Nordstrom’s strategic plans focus on North America, especially the United States. Another unexploited competitive advantage noted in the VRIO/VRIN analysis table is the company’s capability to diversify its online and non-online operations. This factor refers to Nordstrom’s ability to develop new business operations beyond the retail industry. Given the customer centricity and service orientation of its value chain, the company can diversify to other services that complement its existing operations. In the resource-based view, these capabilities are based on Nordstrom’s resources that support new business operations as extension of the existing value chain.

VRIO Analysis of Nordstrom’s Core Competencies (Sustainable Competitive Advantages). In the VRIN/VRIO analysis table, Nordstrom’s brand is considered a core competency because it satisfies the VRIO criteria for long-term competitive advantages. For example, this brand is valuable, rare, and imperfectly imitable in the retail industry. Also, Nordstrom’s operations are organized around maximizing the benefit of this brand. Another core competency based on the VRIO framework is the company’s system of large-scale complementary operations, representing a value chain that captures various retail market segments. The full-line stores offer upscale merchandise and services, while Nordstrom Rack stores provide discounted clothes and accessories. In the resource-based view, as a resource and a capability, this system is valuable, rare, and imperfectly imitable, especially among smaller retailers. In addition, Nordstrom is organized around such a complementary system. The system supports the company’s value chain efficiency and effectiveness, and the strategic objective of optimizing retail inventory turnover. A SWOT analysis of Nordstrom Inc. should identify equivalents of these VRIO core competencies that lead to sustained competitive advantages.

VRIN Analysis of Nordstrom’s Core Resources & Capabilities. In the VRIO/VRIN table, Nordstrom’s VRIO core competencies are also the VRIN core competencies because these resources and capabilities satisfy the “non-substitutability” or “N” criterion. For example, the company’s brand value is strong, and there is no exact substitute for it in the retail industry. Similarly, the brand is non-substitutable in Nordstrom’s value chain’s capability to reach customers. In the resource-based view of the enterprise, this VRIN core competency is a resource that supports competitive advantage against retailers in various market segments. Nordstrom’s marketing mix relies on its brand to draw target customers to the company’s stores and websites. The VRIN analysis framework also points to the company’s complementary retail operations as a core resource and capability for long-term competitive advantage. This system of operations is generally non-substitutable, considering its significance in keeping the company’s profitability despite seasonal changes in fashion and clothing. Unsold merchandise from the company’s full-line stores can be sold at discounted prices at Nordstrom Rack stores. Nordstrom’s operations management fully supports this system and uses these VRIN/VRIO core competencies through a value chain designed to meet various market segments’ needs.

Nordstrom Value Chain Analysis: How the VRIN/VRIO Resources and Capabilities Relate to the Value Chain

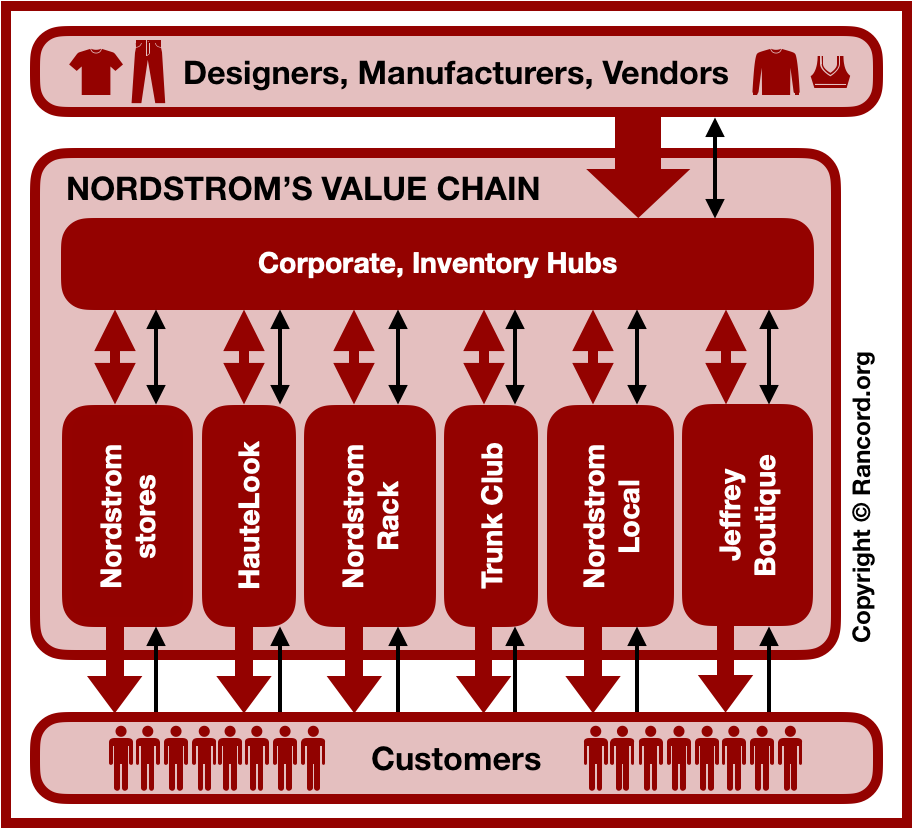

Nordstrom Inc.’s value chain consists of the operations of its full-line stores and subsidiaries, such as Nordstrom Rack and HauteLook. This value chain analysis of the retail business reflects a number of channels that ensure the company’s success in reaching target customers despite fluctuations in market segments. Within the resource-based view, the VRIO/VRIN core competencies are used in these channels and throughout the retail value chain. The following diagram presents a simplified overview of Nordstrom’s value chain and interactions with customers and suppliers:

In the value chain diagram, Nordstrom’s operations interact with target customers. The maroon arrows represent the flow of goods and services, while the black arrows show the flow of data that the business uses to deliver its value proposition as a retail services organization. The arrow originating from the designers, manufacturers, and vendors is a simplified representation of Nordstrom’s supply chain. The double-headed maroon arrows signify the flow of goods among the company’s subsidiaries, such as the movement of unsold merchandise from the company’s full-line stores to Nordstrom Rack stores.

The core competencies identified through the VRIN/VRIO analysis frameworks are used in this retail value chain. For example, Nordstrom’s brand is a resource and long-term competitive advantage that helps maintain the interactions between the business and its customers (the bottommost arrows in the diagram). Also, the VRIO/VRIN core competency of complementary operations helps optimize profitability throughout the corporation’s value chain, despite decline in some subsidiaries due to retail market changes. The double-headed maroon arrows reflect such optimization throughout various retail operations targeting different market segments. In the resource-based view, these VRIN/VRIO core competencies offer sustainable competitive advantages that retain customers within the company’s operations, such as when buyers shift to Nordstrom Rack stores to access discounted items. Note that the subsidiaries shown in the value chain diagram coincide with parts of Nordstrom’s organizational structure.

Key Points from the VRIN/VRIO Analysis and Value Chain Analysis of Nordstrom Inc.

This VRIO analysis of Nordstrom Inc. specifies the company’s brand and system of complementary operations as sustained competitive advantages. These resources and capabilities support the company’s value chain integrity, while enhancing retail sales and profitability. Similarly, the VRIN analysis of Nordstrom identifies the same resources and capabilities as the core competencies responsible for the company’s long-term competitive advantages. The company’s e-commerce and physical locations are where these VRIN core competencies are most notable, especially in customer transactions. On the other hand, in the value chain analysis of Nordstrom Inc., the VRIO/VRIN competitive advantages enable the business to maximize the value of providing apparel and related services to customers. In this internal analysis, the company’s websites and physical stores ensure these divisions’ and subsidiaries’ effectiveness, equating to value chain and operational effectiveness.

References

- Ayers, J. B., & Odegaard, M. A. (2017). Retail Supply Chain Management. CRC Press.

- Barney, J. B. (2017). Resources, capabilities, core competencies, invisible assets, and knowledge assets: Label proliferation and theory development in the field of strategic management. The SMS Blackwell Handbook of Organizational Capabilities, 422-426.

- International Trade Administration of the U.S. Department of Commerce – The Retail Services Industry in the United States.

- Knott, P. J. (2015). Does VRIO help managers evaluate a firm’s resources? Management Decision, 53(8), 1806-1822.

- Mudambi, R., & Puck, J. (2016). A global value chain analysis of the ‘regional strategy’ perspective. Journal of Management Studies, 53(6), 1076-1093.

- Nordstrom Inc.’s Annual Report to the U.S. Securities and Exchange Commission (Form 10-K).

- Nordstrom Inc.’s e-commerce website.

- Salmani, Y., Partovi, F. Y., & Banerjee, A. (2018). Customer-driven investment decisions in existing multiple sales channels: A downstream supply chain analysis. International Journal of Production Economics, 204, 44-58.

- Stonehouse, G., & Snowdon, B. (2007). Competitive advantage revisited: Michael Porter on strategy and competitiveness. Journal of Management Inquiry, 16(3), 256-273.

- Talaja, A. (2012). Testing VRIN framework: Resource value and rareness as sources of competitive advantage and above average performance. Management-Journal of Contemporary Management Issues, 17(2), 51-64.